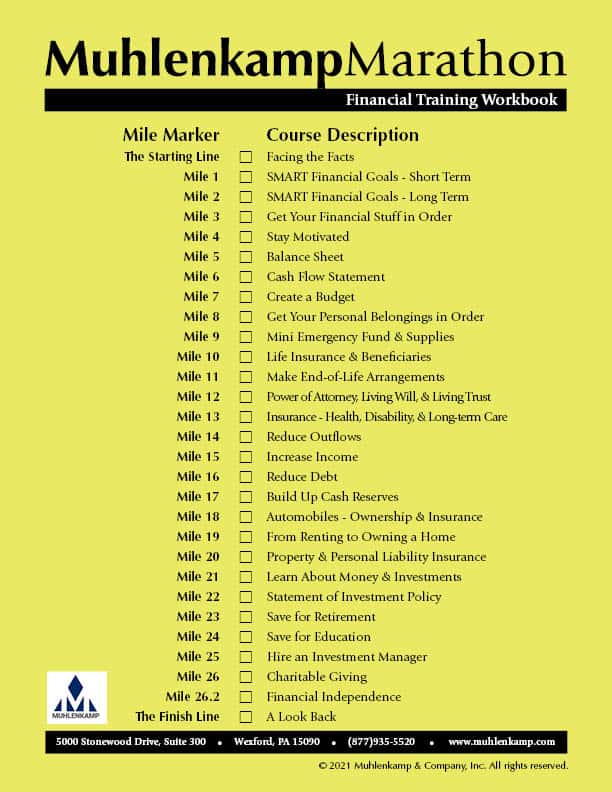

Muhlenkamp Marathon

Our Muhlenkamp Marathon E-Book includes 26.2 miles of financial guidance. From getting your financial information in order at mile 3 to creating a budget at mile 7 and learning how to reduce debt at mile 16, we’ve got your training covered!

The opinions expressed are those of Muhlenkamp and Company and are not intended to forecast future events, guarantee future results, or offer investment advice.

Published On: January 10th, 2021Categories: Investing, Retirement Planning, Saving

Related Posts

-

The Difference Between a Savings Account and InvestingAugust 13th, 2020

-

Thoughts On: Corrections, Crashes, Recessions, and InflationAugust 8th, 2024

-

The Language of InvestingJune 3rd, 2024

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- August 2023

- July 2023

- June 2023

- April 2023

- February 2023

- December 2022

- October 2022

- April 2022

- February 2022

- August 2021

- May 2021

- March 2021

- January 2021

- December 2020

- September 2020

- August 2020

- June 2020