The 2026 Social Security COLA: What Changed and What It Means for Your Retirement

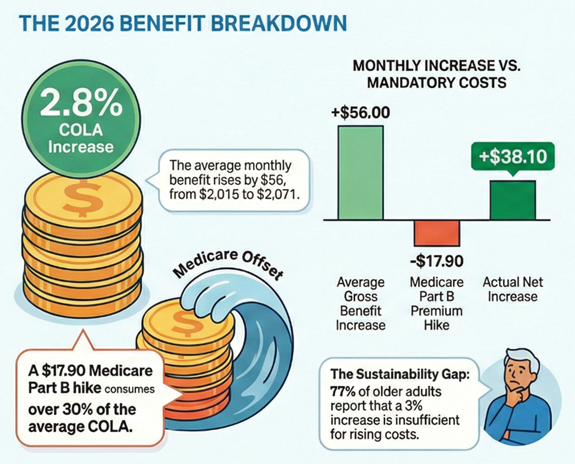

By now, you’ve received your notice from Social Security: benefits increased by 2.8% in January 2026. For the average retiree, that means about $56 more per month—raising the average benefit from $2,015 to $2,071.

If that number feels modest, you’re not alone. In a recent survey, 77% of older adults said a 3% increase wouldn’t be enough to help them keep up with rising prices. And if you’re enrolled in Medicare Part B, the picture gets even more complicated: the standard premium increased by $17.90 per month in 2026, eating into more than 30% of that COLA before you see it.

This is the reality of Social Security in retirement—it’s an important piece of your income, but it was never designed to be the whole picture. And as Tony discussed in his recent article on the “2033 question,” understanding how Social Security fits into your overall plan is essential to making smart decisions about your retirement.

Why the COLA Matters (And Why It’s Not Enough on Its Own)

The Cost-of-Living Adjustment exists to help Social Security benefits keep pace with inflation. Each year, the Social Security Administration calculates the COLA based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). When prices go up, benefits go up—at least in theory.

But here’s the challenge: the CPI-W measures inflation for working people, not retirees. And retirees tend to spend more on healthcare, housing, and other categories where costs often rise faster than the general inflation rate. So even when you get a COLA, it may not feel like it’s keeping up with your actual expenses.

Add in the fact that Medicare premiums are deducted directly from your Social Security check, and you can see why many retirees feel like they’re running just to stay in place.

What the Numbers Look Like

Here’s what changed for 2026:

- COLA increase: 2.8% (up from 2.5% in 2025)

- Average monthly benefit increase: About $56

- Medicare Part B premium increase: $17.90 per month

- Net increase after Medicare: About $38 for the average beneficiary

The 2.8% adjustment is close to the historical average COLA of about 2.6% since 2000. Recent years have been more volatile—we saw an 8.7% increase in 2023 due to high inflation, followed by smaller adjustments as inflation cooled. The 2026 COLA reflects a modest uptick in prices, but nothing like the spikes we experienced a few years ago.

What This Means for Your Retirement Plan

If you’re relying heavily on Social Security to fund your retirement, these modest COLAs are a reminder of why planning matters. Social Security was designed to replace about 40% of pre-retirement income for the average worker. The rest needs to come from somewhere else—pensions, personal savings, investments.

This is where your role as a client comes in. Your financial plan needs to account for the reality that Social Security alone won’t be enough, and that the purchasing power of those benefits will face pressure over time. That means:

Staying in communication with us about changes in your life. If your expenses are rising faster than your COLA, we need to know. If you’re planning a major purchase or dealing with unexpected healthcare costs, those changes affect how we manage your portfolio.

Keeping your plan updated. Retirement isn’t static. Your needs will change, your health will change, and the economy will change. Regular reviews ensure your plan stays aligned with reality.

Understanding how your investments fit with your Social Security. We manage your portfolio to provide returns after taxes and inflation. That means we’re working to grow your purchasing power over time—something Social Security alone can’t guarantee.

The Bigger Picture: Social Security and Your Overall Plan

As we mentioned in our earlier article, Social Security faces long-term funding challenges. The program is projected to be able to pay full benefits only until 2033, after which it would be able to cover about 79% of promised benefits unless Congress acts. That doesn’t mean Social Security is going away, but it does mean uncertainty is part of the equation.

For your retirement plan, that uncertainty means Social Security can’t be your only source of income. You can’t control what Congress does with Social Security, but you can control how much you save, how you invest, and how you plan for different scenarios.

What You Should Do Now

If you haven’t already, take a moment to review your Social Security statement (available at www.ssa.gov/myaccount). Make sure you understand what you’re currently receiving or what you can expect to receive when you claim benefits.

Then ask yourself:

- Is my current spending sustainable given these modest COLAs?

- Do I need to adjust my withdrawal rate from my portfolio?

- Are there changes in my life—new health expenses, a move, family support—that should be factored into my plan?

If any of these questions raise concerns, reach out to us. That’s what we’re here for.

How Can We Help?

We’re responsible for managing your investments—protecting your capital, earning you a decent return, and helping you navigate the ups and downs of the market.

We can work with you to build a retirement plan that doesn’t depend solely on Social Security COLAs to keep you comfortable. Because while a 2.8% increase is better than nothing, your retirement deserves more than “better than nothing.”

If you have questions about how your Social Security benefits fit into your overall plan, or if you’d like to review your retirement strategy, give us a call.

Related Reading:

The comments made are opinions and are not intended to be investment advice, legal advice, or tax advice. Please consult your tax advisor, attorney, and financial advisor before taking any action. Past performance does not guarantee future results.