Social Security and the 2033 Question

Social Security is likely part of your retirement plan—but how much can you actually count on it? And when should you start taking benefits? The answers depend on understanding what Social Security really is, how it works, and where you are in life.

Some observations:

- In Fleming v Nestor (1960), the Supreme Court ruled that Social Security benefits are not an “accrued property right” or contractual obligation. Paying Social Security taxes does not grant a worker a legally binding entitlement to receive specific benefits in the future.

- Social Security has always been “pay as you go,” meaning benefits were paid out of collected taxes. If taxes exceeded benefits in a calendar year, the surplus was deposited into the Social Security Trust Funds. By law, the Trust Funds purchase special-issue US Treasury Securities.

- Prior to 2010, taxes were greater than benefits, and the surplus increased the balance in the Trust Funds. Since 2010, benefits exceeded taxes, and the Trust Funds have been in a period of net redemption to meet benefit obligations.

- Trust Fund balances continued to increase, despite net redemptions, until 2020, then the funds began to deplete. If Congress makes no changes to Social Security, the Trust Funds are projected to reach zero sometime between 2033 and 2035. Note that the Social Security Act of 2025 increased benefits to millions of public service workers, which accelerates the depletion.

- Benefits will continue to be paid when the reserves reach zero; Social Security would not “go bankrupt” but would rely solely on current tax revenue, which is projected to cover approximately 81% to 83% of scheduled benefits.

- According to the Social Security Administration (SSA) actuarial tables, a man who has reached the age of 62 can expect to live to ages 82-84. Roughly 50% of men who reach age 65 will live to at least age 83, which means 50% WON’T live until 83. The same applies to women, with the average life expectancy being 84-86.

So what does this mean for you? It depends on where you are in life.

If you are currently receiving Social Security benefits, figure out the impact of those benefits being reduced by almost 20% in 7-10 years. Then start acting NOW to adjust things in response. Call it risk management, planning for the worst case, whatever; it’s better to start planning now than waiting to “see what happens.”

If you are aged 52-62, log on to the Social Security Administration, download your Social Security Statement, and think about what you are trying to accomplish. There are a few ways to think about your Social Security decisions:

- Minimizing taxes requires timing your benefits with receiving other income, especially IRA Distributions and Required Minimum Distributions. Double-check whether Roth conversions are appropriate (I’ll write more about Roth Conversions in the next article.) Remember, 15% of Social Security benefits are tax-free, which means up to 85% of benefits will be taxed depending on your Adjusted Gross Income.

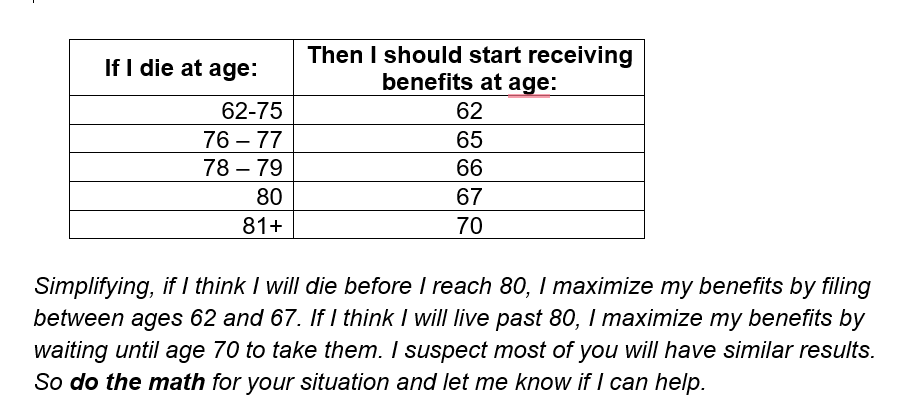

- Maximizing the lifetime Social Security benefits you receive depends on when you file for the benefit AND when you die. While claiming early at 62 provides immediate income, waiting until age 70 often results in higher total lifetime benefits for those who meet or exceed the average life expectancy. Which means we have to do the math. My math says:

- Maximizing assets requires changing our thinking about Social Security; the benefits are not a source of income; they are a source of wealth. Start receiving benefits at age 62, whether you need them or not, whether they are taxable or not. Invest whatever you don’t need to spend into a diversified portfolio of common stocks, and it won’t matter how long you live, the increase in wealth will surpass what you “give up” in benefits. Do the math; let me know if I can help.

If you are more than a decade from retirement, who will be paying taxes into Social Security in order for you to receive benefits? The taxes you pay now are the benefits your parents and grandparents receive; we already know the SSA is not holding “your money.” Your benefits will depend on the taxes your kids and grandkids pay, but birth rates are declining, and families are starting later. The demographic trends are clear, which is why building your own retirement assets matters more than ever.

Currently, the SSA estimates that Social Security Benefits replace 40% of pre-retirement income; that replacement rate is unlikely for younger workers, which means you have to save and invest more consistently to build assets that can support your retirement. We will talk more about saving and investing to build assets in a future article.

Bottom line, you have to do the math to determine a course of action. I’ve covered the main planning considerations, but every situation is unique. If you’d like help thinking through your specific circumstances, give us a call—or come to our spring seminar where we’ll walk through these calculations together.

I look forward to hearing from you.

The comments made are opinions and are not intended to be investment advice, legal advice, or tax advice. Please consult your tax advisor, attorney, and financial advisor before taking any action.