Value Investing Live Recap with Ron Muhlenkamp

GuruFocus invited Ron Muhlenkamp to be a guest speaker on the Value Investing Live series. During Ron’s presentation on August 18, 2021, he covered the following topics: • The Problem with Inflation • Inflation, Business Cycles, & the Population • Failure of Macroeconomics • Fundamental Value • Life Cycle of Industries • Market Corrections • Audience Q&A Graham Griffin, Editorial Assistant at GuruFocus published the following article, “Value Investing Live Recap: Ron Muhlenkamp,” which includes a link to Ron’s presentation. We hope you enjoy the summary and the video! Please note that clicking here leaves the Muhlenkamp and Company website and [...]

Achieve Financial Independence

A Virtual Lunch & Learn Series “Financial Independence: It’s Not a Sprint, It’s a Marathon” Part 3: “Achieve Financial Independence” We talk about achieving financial independence and what retirement means to you. It’s different for everyone, but basically it means that you CAN still work but you don’t HAVE to work to bring in any additional earned income. Start by setting SMART goals, prioritize spending, save and invest early. Have a written plan for retirement and revisit it often. Have a plan to pay for education expenses. Achieve Financial Independence from Muhlenkamp & Co on Vimeo. If you missed Parts [...]

Make More, Spend Less

A New Virtual Lunch & Learn Series “Financial Independence: It’s not a Sprint, it’s a Marathon” Part 2: “Make More, Spend Less” A topic everyone likes to talk about: Increasing Income. A topic no one wants to really talk about: Debt! Just like any fitness plan, you need to move your attention to where it is required! In Part 2 of our Lunch & Learn series, we look at alternatives to making more and spending less. Eliminating debt should naturally help you sleep better at night! WORK TO MOVE YOUR ASSETS TOWARD THE AREAS WHERE RETURNS ARE HIGH AND PAY OFF DEBTS WHERE [...]

Setting Short- and Long-term Financial Goals

A New Virtual Lunch & Learn Series “Financial Independence: It’s Not a Sprint, It’s a Marathon” Part 1: “Setting Short- and Long-term Financial Goals” There are many similarities between training for a marathon and achieving financial independence. Both take desire, time, and effort, and as the saying goes, it’s not a sprint but a marathon of discipline. Just like any fitness plan, once you have reached your goals, you must maintain them. But let’s back up. We need to get you to the Starting Line of the Financial Marathon. THE STARTING LINE At the Starting Line, it’s a time when [...]

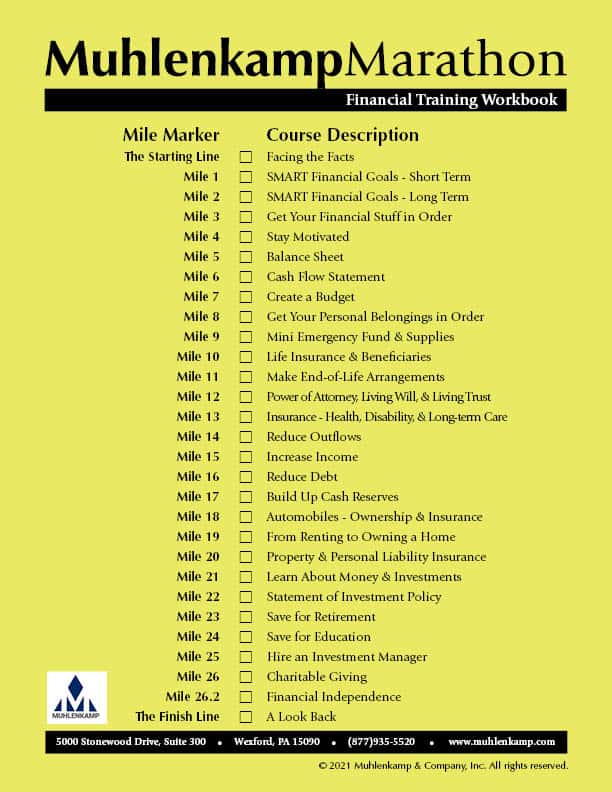

Muhlenkamp Marathon

Our Muhlenkamp Marathon E-Book includes 26.2 miles of financial guidance. From getting your financial information in order at mile 3 to creating a budget at mile 7 and learning how to reduce debt at mile 16, we’ve got your training covered! The opinions expressed are those of Muhlenkamp and Company and are not intended to forecast future events, guarantee future results, or offer investment advice.

Talk to Your Children About Money: From Saving to Financial Legacy

WHY DO WE SAVE MONEY? There isn’t a shortage of information surrounding why to save, how to save, and where to save. And after all, we have to plan for the unexpected and the expected—your first home, kids, college, retirement, and job loss. The list goes on. One thing for sure, saving can be a team sport for you and your family if you encourage it to be. So, talk with your children about money. HOW DO YOU ANSWER THESE QUESTIONS? Why do you save money every month? When do you plan to retire; earlier than the age of 66? [...]

Why an Emergency Fund is a Good Idea

An emergency fund is the rainy-day fund; it’s for the out of the ordinary, once in a blue moon expense that you need money for RIGHT NOW. It is for expenses that are both URGENT and IMPORTANT, and the purpose of this money is to be available when you need it. Most financial advisors and bankers will tell you that you should have at least the equivalent of three to six months’ worth of living expenses saved in this emergency fund. WHY IS SIX THE MAGIC NUMBER? If you’re far out from retirement and have a steady job, keeping six [...]

The Difference Between a Savings Account and Investing

The words saving and investing seem to always go together, like peanut butter and jelly, or death and taxes. And they do belong together, because before you can invest, you have to save. Saving is spending less than what you make and putting the difference aside for later. It’s delayed gratification, it’s the old fable about the summer ant and the winter ant. Saving is taking precautions against, and preparing for, an unknown and predictable future. Investing takes that one step further, and it’s largely a function of your time horizon for the money you are making and saving. Savings [...]

Mapping Your Financial Future: It’s Never Too Late to Save for College

Our webcast, led by Tony Muhlenkamp, takes a fresh look at an old topic: how do we save for college? Given the past few months, should we change the way we plan and save for our children’s education? Watch the webcast to hear our ideas on planning for your financial future. MAPPING YOUR FINANCIAL FUTURE - It’s Never Too Late to Save for College.2020.05.28 from Muhlenkamp & Co on Vimeo. If you have questions or comments about the content of the webcast, don’t hesitate to send us a message or call us at (877)935-5520. The opinions expressed are those of Muhlenkamp and [...]

Make More, Spend Less – Invest the Difference

Financial Health and Wellness has a LOT in common with Physical Health and Wellness; especially in the sense that everyone knows it’s important; and they even know how to do it (make more, spend less, invest the difference), but very few people actually do what it takes to achieve it. John Templeton once explained to a reporter his secret for becoming wealthy; for the first 20 years out of college, he saved half of everything he earned. Period. Now John Templeton is a LEGENDARY investor and earned good returns for his clients by investing. But his SECRET to wealth was [...]